PrimeQ, a forward-thinking startup, has achieved significant milestones in the first quarter of this year, catering specifically to potential investment funds seeking innovative trading solutions. Key highlights include:

- Advanced Technical Foundation: PrimeQ has established a robust and scalable technical infrastructure, crucial for hedge funds seeking innovative trading solutions.

- Data Access and Integration: Integration with prominent exchanges like Binance, Alpaca Markets and QuantConnect, empowers funds with comprehensive data insights.

- Risk Management: PrimeQ has developed basic features of a risk management tool (eg. stop loss / take profit) for hedge funds aiming to safeguard capital.

- Efficient Strategy Execution: The Strategy Manager Service offers seamless initiation, monitoring, and control of strategies, enhancing hedge funds’ portfolio management.

- AI-Powered Insights: PrimeQ’s initial machine learning tests showcase an XGBoost model with promising predictive capabilities, particularly in identifying local extremums – providing hedge funds with data-driven insights.

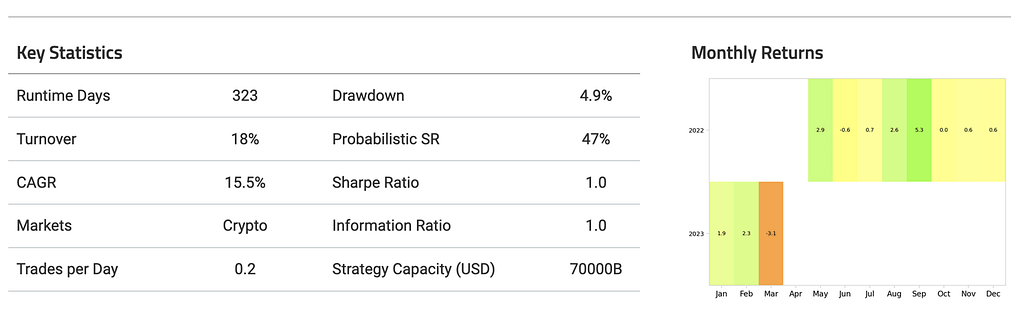

- Positive Performance: The XGBoost model achieved a balanced f1-score of up to 60-65%, with backtest results outperforming the market at a 75% prediction probability target.

PrimeQ’s Q1 2023 accomplishments offer a reliable and innovative AI-driven trading solution, with a focus on scalability, data insights, risk management, efficient execution, and strong performance results.

Summary

Business priorities

- Company registration

- Research grant received

- Research started

Research priorities

- Data collected and processed

- AI tests started

- First positive results received

Team and cooperation

- Core team established

- Quants and IT specialists hired

- Cooperation with a VC started